In launching the Great Economy Project, a group of American millionaires have deepened their resolve to ensure that they and their fellow wealthy Americans pay their fair share in support of the country that enriched them. The project’s goal is to start a grassroots movement that will focus voters on electing politicians committed to reducing extreme wealth inequality by raising taxes on the rich and increasing the minimum wage.

“Raise your hand if you think the economy is rigged in favor of the rich.”

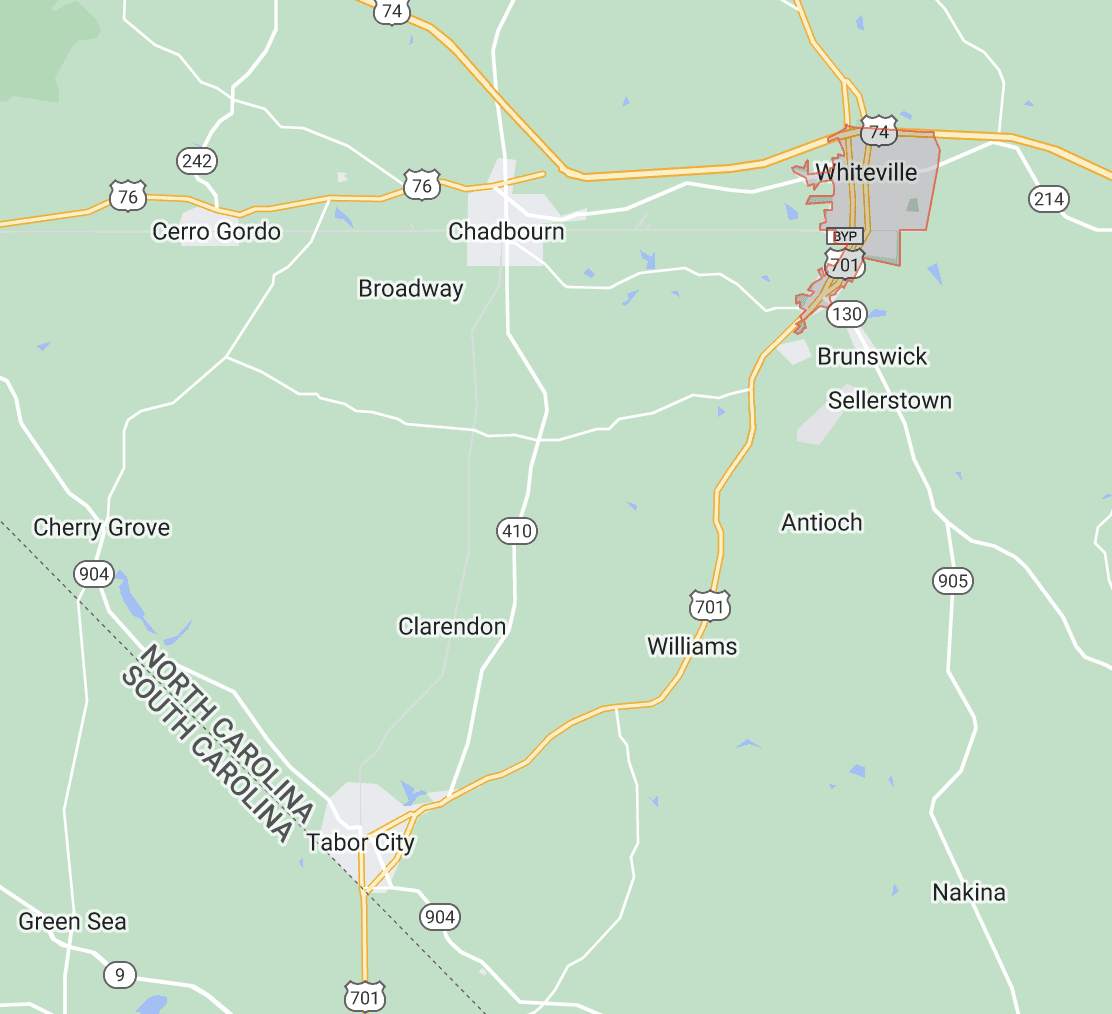

That’s how Erica Payne, president of Patriotic Millionaires, energized the conversation at a $50-a-plate dinner in Whiteville, North Carolina – that is, $50 paid by the Millionaires to each resident of Whiteville who agreed to take their money and come for the free meal in exchange for talking about the economy.

After a roomful of hands stuck in the air, Payne asked, “If you want to raise taxes on billionaires, raise your hand.” Again, a roomful of hands shot up.

In those moments, the people of Whiteville who had gathered that night – about 75% Republican, 20% Democrats, and 5% Independent – had found common ground. By the time the Millionaires had finished introducing themselves and the Great Economy Project to Whiteville, 90% of the 60 attendees were prepared to spread the word to their fellow community members in an effort to recruit more voters who were ready to unrig the economy.

The Great Economy Project, launched in Whiteville in 2022, had notched its first important achievement in a long-term strategy to change the nation’s tax code – and along with it, the culture of the country.

About Whiteville, NC

As of 2020, the total population was 5,348.

The median individual income was $20,722.

Almost 1 of every 4 residents fell below the federal poverty level.

More than 15% of households had income under $10,000.

Whiteville is located in Columbus County. In 2020, the party affiliation of registered voters in the county broke down as follows: Democrat – 16,737; Republican – 7,744; Other party – 111; Unaffiliated – 10,112.

After a decade of PR victories that produced little change, the Patriotic Millionaires have recognized the need to approach their goals from the bottom up as well as the top down. According to the organization’s board chairman, Morris Pearl, the group was not winning by working the media and lobbying Congress. It simply was not enough to showcase the passion of a nonpartisan group of high net worth Americans who believe that a strong America depends on a fair economy that neutralizes built-in economic disparities. With Payne leading the charge, the millionaires recruited to the cause have now rolled up their sleeves for the hard work of engaging despairing and disillusioned voters across the country.

The organization’s members all have an annual income of at least $1 million or assets over $5 million, and they all share the belief that an economy where money flows disproportionately to the top is not only unfair, it is destined to collapse. On Tax Day, they released Crack the Code: The Internal Revenue Code of 2025, a proposal for revamping the tax code that serves as a potential starting point in the expected debates over the 2025 expiration of the Trump tax cuts of 2017. The Millionaires’ proposal includes three fundamental objectives:

- Tax all income over $1 million equally. That means that whether the income is earned on the job, passed down through inheritance, or the result of good long-term investments, it is taxed the same. Currently, for individuals, any amount of earned income greater than $578,125 would be taxed at 37%, and any amount of investment income would typically be taxed at 15%. Under the Millionaires’ proposal, all income over $1 million would be taxed at a minimum rate of 39.6%.

- Implement a new progressive tax that would start at 39.6% for income between $1 million and $5 million and peak at 90% for anyone with income over $100 million.Anyone earning less than a living wage would pay no income tax. The living wage, which would be based on something akin to MIT’s Living Wage Calculator, can be double or more than triple the federal minimum wage of $7.25, depending on geographic location.

- Implement a small but progressive wealth tax on what the organization calls “runaway wealth” in which the normal costs of everyday living (e.g. rent/mortgage, groceries, healthcare, saving for retirement) do not constrain wealth accumulation. The tax would affect those whose wealth was 1,000 times greater than the median household wealth. In 2020, the median household wealth was $140,800, meaning the wealth tax would kick in on those with more than $140.8 million.

The proposal includes a variety of other recommendations that would relieve the tax burden of those at the lower end of the economic ladder and limit deductions and loopholes that benefit the rich.

Every member of the Patriotic Millionaires would be affected by their proposal. The “poorest” members of the group – those with total income between $1 million and $5 million – would see their tax rate increase by 2.6%, to 39.6%. At the other end of the scale, we’ll take a look at Abigail Disney, one of the group’s most outspoken members whose net worth in 2019 was reported by Forbes to be $500 million. We have been unable to confirm this figure (and have seen a much lower estimate reported since then), and use it here only to help illustrate the impact that the Millionaires’ tax proposals will have on themselves.

In lieu of actual documentation, we are assuming that Disney’s wealth is fully invested and generating an 8% return, all as realized gains. If we further assume that this is her only source of income, her earnings for the year would be $40 million, putting her in the Millionaires’ 70% tax bracket. Taxed at this rate, she would pay $23.98 million in income tax. (Of course, in this oversimplified example, we did not consider possible investment losses, deductions, and other circumstances that might change her tax liability.)

Because Disney is rich enough to qualify for the bottom bracket of the Millionaires’ proposed progressive wealth tax, she would also pay a 2% wealth tax. Based on her reported net worth, this means she would pay slightly less than $10 million in additional tax. Nevertheless, despite her tax burden in this example, Disney would still be $6 million wealthier.

The 250 members of this millionaires club believe it is a patriotic duty to pay their fair share of taxes, and they think that the current tax code fails to demand it of them. While they could voluntarily give away the additional money, as some critics have suggested, the Millionaires make the point that without the other high net worth and ultra-wealthy Americans doing the same, the problems of extreme wealth concentration – including the dominance of money in politics – will persist. With the Trump tax cuts due to expire in 2025, the Patriotic Millionaires see an opening to begin the process of rewriting the tax code to create a more fair, just, and stable America.

The Great Economy Project aims to build a movement from the ground up to achieve that goal so that the tax code better reflects American values of fair treatment of labor, equal opportunity to accumulate wealth, and an equal voice for all citizens in our democracy. The Patriotic Millionaires recognize that Republicans have long refused to accept any discussion of raising taxes, and they’ve similarly noted that Democrats, when they’ve had the opportunity to act, have failed to do so. The group understands it cannot achieve its goals alone. It needs the American people to cast their votes for the candidates who support their cause.

The Millionaires also understand the close relationship between the press and politicians. They like to remind their supporters that politicians, like magicians, are masters of distraction and misdirection, leading Payne to implore the residents of Whiteville to be single minded about focusing on “money money money money money money”. For the Millionaires, the top priority for the nation’s democracy is fixing the problem of extreme wealth inequality.

Consequently, Payne urged her audience not to get distracted by talk of defunding the police, abortion, guns, climate change, race, or other topics promoted by politicians and interest groups and then echoed in the media. She wants participants in the Great Economy Project to understand that their votes need to go to candidates who support taxing the rich.

Her message to the people in Whiteville who were gathered for that free dinner was simple and direct: “You have more power than the billionaires do – if you use it.”

Author: George Linzer

Published: May 16, 2023

Feature image: iStock photo by Smederevac

Sources

Patriotic Millionaires Spring Meeting, “American Agenda – The Money Part”, attended Apr 17, 2023. A video of the event and list of speakers is available at https://patrioticmillionaires.org/spring-meeting/.

Patriotic Millionaires press event with multiple speakers and interview with Morris Pearl, US Capitol, Apr 18, 2023

US Census, “Whiteville, NC”, Data Commons, 2020, https://datacommons.org/place/geoId/3773660/?utm_medium=explore&mprop=income&popt=Person&cpv=age,Years15Onwards&hl=en, accessed May 15, 2023

US Census, “Whiteville Economics”, Data Commons, 2020, https://datacommons.org/place/geoId/3773660?category=Economics, accessed May 15, 2023

Ivey Schofield, “Voters leaving the Democratic Party in Columbus County”, The News Reporter, Sep 15, 2020, https://www.nrcolumbus.com/news/elections/voters-leaving-the-democratic-party-in-columbus-county/article_35ac222c-cc70-55e5-b9fc-3d9d35790314.html, accessed May 15, 2023

Patriotic Millionaires, “Crack the Code: The Internal Revenue Code of 2025”, Apr 18, 2023, https://static1.squarespace.com/static/643066008ad89d41f9a584c1/t/6439714b698938692be04a39/1681486160147/Crack+The+Code.pdf, accessed May 9, 2023

Patriotic Millionaires, “The Great Economy Project”, https://static1.squarespace.com/static/63b88109003c981ca70b5ddb/t/6438104928b9731e7eec17c6/1681395788925/Whiteville+Meet+and+Greet.pdf, accessed Apr 19, 2023

Patriotic Millionaires, “The Great Economy Project (Trailer) – Money”, https://youtu.be/O4SQxjIoY-I, accessed Apr 20, 2023

Patriotic Millionaires, “The Patriotic Millionaires Go to Whiteville”, https://www.youtube.com/live/bKE48Vk2Q2Q?feature=share&t=812, viewed on Apr 17, 2023

Internal Revenue Service, “IRS provides tax inflation adjustments for tax year 2023”, Oct 18, 2022, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023, accessed Apr 21, 2023

Internal Revenue Service, “Topic No. 409, Capital Gains and Losses”, Apr 4, 2023, https://www.irs.gov/taxtopics/tc409, accessed Apr 21, 2023

Donald Hayes, Briana Sullivan, “The Wealth of Households: 2020”, US Census Bureau, Aug 2022, pg. 2, https://www.census.gov/content/dam/Census/library/publications/2022/demo/p70br-181.pdf, accessed May 9, 2023

Internal Revenue Service, “IRS provides tax inflation adjustments for tax year 2023”, Oct 18, 2022, https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023, accessed Apr 24, 2023

Jack Kelly, “Abigail Disney’s Criticism of CEO Bob Iger’s Pay Raises Difficult Questions”, Forbes, Apr 24, 2019, https://www.forbes.com/sites/jackkelly/2019/04/24/the-story-of-a-disney-heiress-who-criticizes-the-ceos-pay-and-ignites-a-firestorm/?sh=3272a5f63086, accessed May 8, 2023

Have a Suggestion?

Know a leader? Progress story? Cool tool? Want us to cover a new problem?