Preview of forthcoming problem brief

Following World War II, Americans experienced unprecedented economic growth that, for the most part, filtered throughout most levels of the economy and helped lift millions of people into the middle class. This meant that the rate of income improvement for those families was keeping pace with, and even briefly exceeded, that of the wealthiest 5% of Americans.

Two gas crises and a changing global marketplace slowed growth and set off a period of high inflation in the 1970s. Then, in 1980, Americans elected a president who promised to slow to a trickle the flow of wealth from the top of the economy to the bottom, and the idea that profit as the sole objective of business came to dominate American culture.

The spirit of the time was effectively captured in the “greed is good” speech from one of 1987’s top-grossing films, “Wall Street”. In fact, in May 1986, more than a year before that movie was released, a real-life Wall Street wheeler-dealer named Ivan Boesky gave a commencement speech to the School of Business Administration at the University of California, Berkeley in which he said, “Greed is all right, by the way. I want you to know that. I think greed is healthy. You can be greedy and still feel good about yourself.” According to reports at the time, this line elicited laughter and applause. By the end of 1986, Boesky had been fined $100 million by the Securities and Exchange Commission for illegal insider trading.

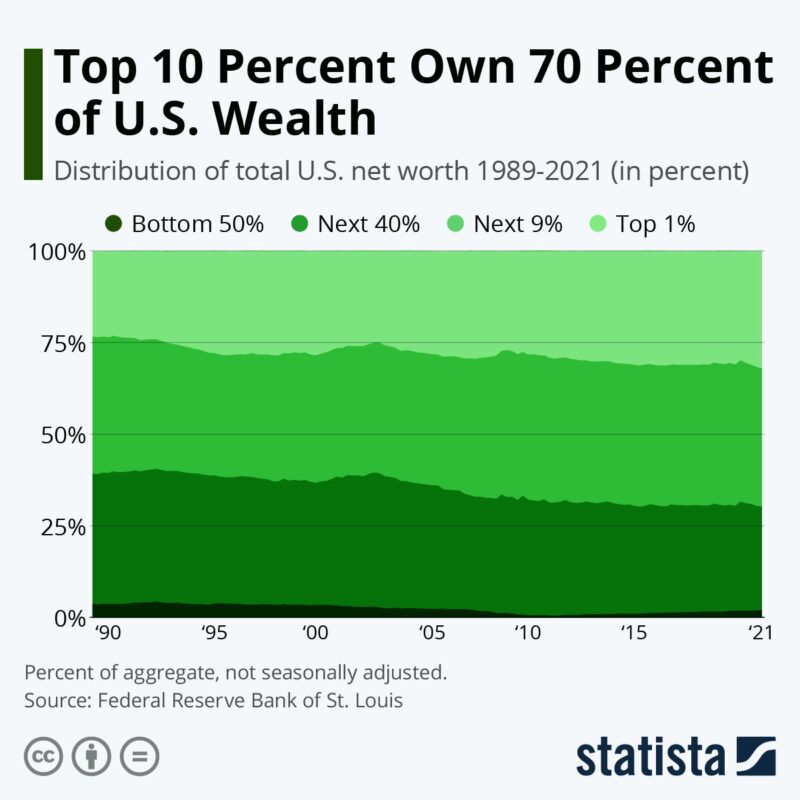

Since 1980, the share of income and concentration of wealth heavily favored the richest 10% of Americans. According to Statista, the top 10% of the richest Americans own 70% of the nation’s wealth. Executive compensation at the largest companies soared while average worker salaries stagnated until very recently, and those earning at the lower end of the pay scale have fallen behind. The concentration of wealth in the hands of so few Americans is approaching levels not seen since before the Great Depression.

Given that the health of our economy is often measured by consumer confidence and consumer spending, circumstances that take spending money out of the hands of the majority of consumers puts the economy at risk. And extreme concentrations of wealth tilt the scales of political and economic power in favor of the rich, threatening the values and stability of our democracy.

SUBSCRIBE here to find out when the brief is available