| Problem Addressed | Income and Wealth Inequality, National Debt |

| Solution | Created an organization of millionaires who advocate for taxing the wealthy |

| Location | Washington, DC |

| Impact | National |

What she did

Erica Payne got some of her millionaire friends to co-sign a letter to President Obama urging him to let the Bush-era tax cuts expire just when it looked like he would extend them (which he did). That single act led to the creation of Patriotic Millionaires, a group of people who have more than $5 million in assets or $1 million in annual income who believe they and others like them should pay more taxes to ensure that our democracy can thrive.

Her story

Erica Payne and her patriotic millionaires are openly contemptuous of the wealthy people and corporations that strive to avoid paying taxes. In her view, their refusal to pay taxes and their “investments” in keeping the tax code favorable to them is a betrayal of American ideals and an economic system that enabled them or their families to acquire millions and even billions of dollars.

The unequal treatment of money – that people with earned income will pay taxes and those with investment income can get away with paying no taxes – is “the original sin at the heart of our tax code”, according to Payne. She’s blunt and not known for her subtlety. Unlike groups that advocate talking through partisan differences, she is not interested in engaging opponents in a discussion because, she says, “people who disagree with our philosophy on taxes are wrong”, so what is there to discuss?

In launching Patriotic Millionaires, Payne sought to change the conversation around taxes and rewrite the story Americans had been hearing almost nonstop from conservatives dating back to Ronald Reagan. That conservative storyline, says Payne, is implicitly if not overtly racist, and supports the illusions that wealth is created in a vacuum free from the labor of others and that taxes are a legalized form of theft by a socialist government.

Patriotic Millionaires, on the other hand, tells the story of a bunch of capitalists who recognize how they benefit from the unfair American system of labor and taxation. They see how wealth is concentrated in the hands of so few – almost 70% of wealth is owned by the richest 10% of Americans – and understand it as a threat to American economic growth and the long-term viability of American democracy.

“Tax reform” seems too meek and ambiguous a term to describe their goal. They want to re-prioritize the tax code to better reflect American values of hard work, family, and community.

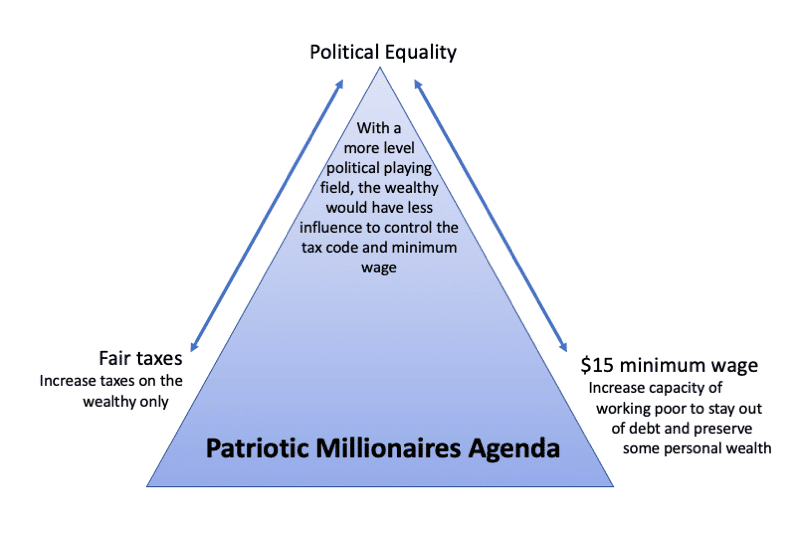

In addition to reprioritizing the tax code, the Patriotic Millionaires campaign for political equality and raising the national minimum wage to $15 an hour. The three issues are very much related: Reducing wealth inequality is a big step to reducing political inequality, and by reducing political inequality, the wealthy would exert less influence on the systemic structures like the tax code and the minimum wage that support the status quo.

Patriotic Millionaires – In Their Own Words

Erica Payne is not, herself, a millionaire, at least not by the organization’s definition. The Patriotic Millionaires define a millionaire as someone who has assets worth more than $5 million or who has an annual income of $1 million or more. The members of the organization either created or joined businesses that enabled them to build their wealth, like George Zimmer of Men’s Warehouse fame, or they inherited their wealth, like Disney heiress Abigail Disney.

“I don’t want to pay taxes. But [contrary to conservative thinking] the reason why I don’t want to pay taxes has little to do with what I think of government…. I realize that government of all types— federal, state, and local — serves society in ways that myself and other fortunate people won’t. The rich don’t feed and house the less fortunate; educate the masses (people who can’t afford the private schools that we send our kids to); they don’t build roads and other infrastructure that society needs to grow and prosper; or fight wars, many of which, if not most, we shouldn’t fight. Government does and always has performed these tasks. It’s silly to think the rich ever will.”

—Stephen Prince, early innovator in the gift card market

“People who amass enormous amounts of wealth do so by relying very heavily on public services. You know Disneyland would never have happened if Eisenhower hadn’t invested in the highways.”

—Abigail Disney, great niece of Walt Disney

“I signed up … to add my voice to the vital movement of rescuing our democracy from the grip of money and bad economics.”

—Geoff Coventry, co-founder of Tradewind Energy, Inc.

“I don’t want to add to my personal net worth at the expense of my fellow Americans. I can pay more, I should pay more, and I reject the false concept that we wealthy Americans are the job creators who will leave the country with our money if we’re asked to pay our fair share. Who wants to live in a country filled with angry, resentful, desperate people? Wealth does not trickle down — it rises to the top, vastly assisted by special tax laws that exempt or reduce the tax bills of those most able to pay to support our country.”

—Karen Stewart, real estate investor who “earned much of my own wealth through my knowledge of the American tax system and the advantages it gives to wealthy investors.”

“The average American knows the system is rigged. They’re not sure how, but they know they don’t have an equal opportunity.”

—George Zimmer, founder of Men’s Warehouse

A Chance Beginning

The organization got its start in 2010 at a time when President Obama was considering extending Republican tax cuts enacted under President George W. Bush. This possibility so infuriated Payne that she and about 15several millionaires she knew sent a letter to the White House urging Obama to let the tax cuts expire “for the good of the country.” That didn’t happen – Obama “caved” to Wall Street, according to Payne – but the informal group she dubbed “Patriotic Millionaires” took root.

What happened next is a little hazy in Payne’s memory, but according to the internet archive, the Wayback Machine, the Patriotic Millionaires website launched on or shortly before April 16, 2011. The home page was dominated by a letter addressed to the President, the Senate Majority Leader, Harry Reid, and the Speaker of the House, John Boehner, and it was signed by 77 millionaires, including Abigail Disney, actress Edie Falco, and Morris Pearl.

At the time, Pearl was a managing director at BlackRock, a multinational investment management corporation. The organization gained traction in the media even as it seemed in constant organizational flux. During those first few years, Payne says she and Morris got to know each other and eventually formed a partnership that has been “transformational”. Morris left his job at BlackRock in 2014 to join Patriotic Millionaires full-time (he takes no salary; he and the other members fund the organization). At around that same time, Paynes recalls, the organization took on a more stable identity and organizational structure.

With Pearl as Chairman of the Board and Payne as President, the two are a complementary pair, Payne says, with Pearl the policy expert and grounding force and Payne “much more like the cheerleader and marketing attack dog”. (Payne is perhaps reflecting her past as a high school cheerleading champion.)

That Name

The name “Patriotic Millionaires” is like a photo – worth a thousand words. It paints a picture that, depending on your perspective, communicates different things. For Payne, it is the cornerstone of the story she wants to tell. It’s the in-your-face effort “to say that paying taxes is fundamentally part of your patriotic duty, and it is an embarrassment to all of us that you are shirking that responsibility.”

She readily admits, however, that some of those she has embarrassed are her own members, who are often initially shy to identify themselves as a millionaire. “Our members hate the name”, she says, but she won’t change it because it speaks directly to people who believe they are patriots but who have been messaged to death that the government is the problem and it wants to steal their money.

To the cynic, of course, the name can elicit a bit of a disbelieving sneer. With a system rigged, as Payne and her members attest, to support the rich, it’s understandable to wonder whether there is more than altruism behind their efforts. It’s a question that is readily answered by the likes of Pearl and others, who admit to their own greed and who built and maintain their wealth on a consumer economy (think Disney) – and so they rebel against the extreme income and wealth inequality that takes money out of the pockets of the very consumers who support them.

The Patriotic Millionaires also like to cite Nick Hanauer, a self-identified plutocrat who has not joined the group even though he shares their belief that the rich must pay more in taxes. He has written and delivered a TED talk on why. His reasoning is based not on altruism but on fear – fear that, he says in a reference to the French Revolution, the angry mobs will be coming for him and his fellow plutocrats with pitchforks. As a committed capitalist, Hanauer sees rising inequality as a practical problem that is bad for business and bad for the democratic freedoms on which business innovations thrive. In his own way, he is aligned with the Patriotic Millionaires, but he manages to escape identifying himself with Payne’s embarrassing moniker.

Increasing Activism

Over the years, Payne and her engaged members have used their marketing savvy and lobbying clout to campaign against repeal of the federal estate tax, oppose the Trump tax cuts, support the $15 minimum wage, and, more recently, advocate for President Biden’s Build Back Better plan. In October, Payne and Pearl visited Senator Joe Manchin’s office in Fairmont, West Virginia to urge him to live up to his support for the closure of tax loopholes by voting for the Biden plan.

Payne doesn’t track the group’s wins and losses very closely, though she is quick to point out the tax-related revenue-raising elements of Build Back Better. Nor does the organization miss an opportunity to applaud when states like Delaware approve a $15 minimum wage. Culture change is a marathon, not a sprint, in her view. She prefers instead to monitor how many people they reach with a message of different priorities, noting that last year the group appeared in 1,800 news stories in 75 countries and in all 50 States.

In April 2021, Payne and Pearl published “Tax the Rich! How Lies, Loopholes, and Lobbyists Make the Rich Even Richer”, a primer that explains how the tax code has been rigged by the wealthy to support the wealthy. It also lays out ideas for how it can be effectively rewritten, identifying seven “tax tricks” that should be eliminated from the tax code and 10 lies that are told by the rich in defense of the status quo.

In her note at the beginning of the book, Payne writes that when she was a little girl she didn’t dream of working on tax policy. Ten years after starting Patriotic Millionaires, she says she doesn’t work on tax policy because she wants to, but “because I want my five-year-old daughter to grow up in a stable, peaceful, and prosperous country.”

Payne believes that our country is a fading democracy and that the priorities expressed in the tax code are a major contributor to its fall. “I think the point for subtlety is past. We are at a crisis point. Elon Musk pays a lower tax rate than I pay. That is ridiculous.”

The Great Economy Project Finds Common Ground

Patriotic Millionaires’ Great Economy Project wants Americans to vote for candidates who will raise taxes on the rich, increase the minimum wage, and reduce taxes for people who aren’t earning a living wage.

Written by George Linzer

Published on December 14, 2021

Sources

Erica Payne, interview with George Linzer, Oct 28, 2021

Follow up emails with Sam Quigley, Communications Director, Patriotic Millionaires

Morris Pearl, Erica Payne, “Tax the Rich! How Lies, Loopholes and Lobbyists Make the Rich Even Richer”, The New Press, Kindle Edition, 2021

LinkedIn, Erica Payne profile, https://www.linkedin.com/in/erica-payne-b8812523/, accessed Oct 18, 2021

Megan Leonhardt, “The top 1% of Americans have about 16 times more wealth than the bottom 50%”, CNBC, Jan 23, 2021, https://www.cnbc.com/2021/06/23/how-much-wealth-top-1percent-of-americans-have.html, accessed Dec 6, 2021

Stephen Prince, “Why I Am A Patriotic Millionaire: Stephen Prince”, Patriotic Millionaires, Apr 28, 2016, https://patrioticmillionaires.org/2016/04/28/why-i-am-a-patriotic-millionaire-stephen-prince/, accessed Dec 6, 2021

Adam Gabbatt, “’Traitors to their class’: meet the super rich who want to be taxed more”, The Guardian, Dec 13, 2019, https://www.theguardian.com/us-news/2019/dec/13/patriotic-millionaires-super-rich-want-to-be-taxed-more, accessed Dec 7, 2021

Geoff Coventry, “Why I Am A Patriotic Millionaire: Geoff Coventry”, Patriotic Millionaires, Sep 7, 2016, https://patrioticmillionaires.org/2016/09/07/why-i-am-a-patriotic-millionaire-geoff-coventry/, accessed Dec 6, 2021

Karen Stewart, “Why I Am A Patriotic Millionaire: Karen Stewart”, Patriotic Millionaires, Feb 8, 2020, https://patrioticmillionaires.org/2020/02/08/why-i-am-a-patriotic-millionaire-dr-karen-seal-stewart/, accessed Dec 7, 2021

Patt Morrison, “George Zimmer, a millionaire with a plan to help the middle class”, Los Angeles Times, Jul 8, 2015, https://www.latimes.com/opinion/op-ed/la-oe-morrison-zimmer-20150708-column.html, accessed Dec 6, 2021

Clayton Henkel, “Patriotic Millionaires founder Erica Payne discusses her new book:Tax the Rich!”, NC Policy Watch, radio interview, May 10, 2021, https://ncpolicywatch.com/2021/05/10/patriotic-millionaires-founder-erica-payne-discusses-her-new-booktax-the-rich/, accessed Dec 7, 2021

LinkedIn, Morris Pearl profile, https://www.linkedin.com/in/morris-pearl-1410164/details/experience/, accessed Dec 7, 2021

Guidestar, Tesseract Inc. Form 990, 2018, https://pdf.guidestar.org/PDF_Images/2018/800/378/2018-800378174-17028373-9O.pdf?_gl=1*t7p4a8*_ga*MTQ5NzIzODk2OS4xNjM4OTIxNjY1*_ga_5W8PXYYGBX*MTYzODkyMTY2NS4zLjEuMTYzODkyMTczNS4w*_ga_0H865XH5JK*MTYzODkyMTY2NS4zLjEuMTYzODkyMTczNS4w&_ga=2.250627845.246435842.1638921666-1497238969.1638921665, accessed Dec 7, 2021

Sheelah Kolhatkar, “The Ultra-Wealthy Who Argue That They Should Be Paying Higher Taxes”, The New Yorker, Dec 30, 2019, https://www.newyorker.com/magazine/2020/01/06/the-ultra-wealthy-who-argue-that-they-should-be-paying-higher-taxes, accessed Oct 18, 2021

David Kirk, “’Patriotic Millionaires’ petition Joe Manchin to tax the rich”, Times West Virginian, Oct 15, 2021, https://www.timeswv.com/news/local_news/patriotic-millionaires-petition-joe-manchin-to-tax-the-rich/article_66acdb9c-2d31-11ec-9bc1-2f8acb3f7f86.html, accessed Dec 8, 2021

Goodreads, reader comments, https://www.goodreads.com/book/show/57444989-tax-the-rich, accessed Oct 18, 2021

Influence Watch, “Erica Payne”, https://www.influencewatch.org/person/erica-payne/, accessed Oct 26, 2021

Juliana Kaplan, Andy Kiersz, “The wealthiest Americans now own almost all of the stock market — 89% to be exact”, Business Insider, Oct 19,2021, https://www.businessinsider.com/wealthiest-americans-now-own-record-high-share-of-stocks-2021-10, accessed Oct 26, 2021

Caitlin Oprysko, “Patriotic Millionaires threaten retaliation against moderate Dems”, Politico, Sep 10, 2021, https://www.politico.com/newsletters/politico-influence/2021/09/10/patriotic-millionaires-threaten-retaliation-against-moderate-dems-797545, accessed Oct 26, 2021

Have a Suggestion?

Know a leader? Progress story? Cool tool? Want us to cover a new problem?