The national debt was notably absent from the Democratic debates all through 2019, but it is getting attention now in the midst of our national turmoil. Despite the COVID-19 pandemic and economic crisis, and the demonstrations sparked by the murder of George Floyd, the national debt has returned to the spotlight thanks to a concerned basketball player and a new accountability tool for COVID relief spending from a nonpartisan advocate for fiscal responsibility.

Rising NBA star Spencer Dinwiddie, a guard for the Brooklyn Nets, recently raised awareness of the issue by tweeting his intentions to place the word “trillion” above his No. 26 jersey number — a reference to the $26 trillion gross national debt at the time.

“[There are a] lot of issues at the moment. I think the fact that the country is 26 (ironically) Trillion dollars in debt is high on the list,” Dinwiddie wrote in a lengthy tweetstorm that offered his proposed solutions to resolving the debt.

While Dinwiddie was bringing attention to the debt beyond political circles, the Committee for a Responsible Federal Budget (CRFB) started to keep an eye on the emergency spending passed by Congress in response to the pandemic. Having created a similar tracker during the Great Recession, the CRFB launched the COVID Money Tracker, a tool that tracks the disbursement of federal relief funds. Despite its concerns about pre-pandemic debt levels, CRFB recognized the need for emergency, debt-increasing relief legislation while also demanding accountability for the spending of COVID-19 aid.

As part of its work, the CRFB analyzed one of the government’s most prominent relief efforts, the Paycheck Protection Program (PPP): forgivable loans that Congress designed to help businesses throughout the country retain employees during mandatory quarantines. Two congressional PPP bills were passed to relieve businesses, and the CRFB found that almost three-quarters of the money distributed to date has gone to only a small fraction of the 4.9 million businesses in need. Additionally, the federal data used for the CRFB analysis revealed that larger businesses — defined as businesses that received at least $150,000 from the federal U.S. Small Business Administration (SBA) — received on average $575,000 while smaller businesses averaged $33,500.

The CRFB based its analysis on SBA data of all of the PPP business recipients and includes a breakdown of PPP recipients by congressional district in its COVID Money Tracker July Update. As might be expected, the list’s top congressional districts on the list have a high density of business activity in areas like New York City, Houston, Denver, and Los Angeles.

The COVID Money Tracker July Update also broke down PPP forgivable loans distributed per industry and lender as well as their benefit to small businesses so far. According to a Census Bureau Small Business Pulse survey analyzed by the CRFB, the forgivable loan program seems to be having its desired effect. Small business owners say they have more cash on hand than what was available early in the pandemic, and conditions improved and remained steady as more PPP money was dispersed. In fact, almost all successful applicants have now received their money and Congressional Budget Office projections show unemployment gradually declining.

But the help may not last. The CRFB forecasted in June that businesses would need more support beyond the 8 weeks of help provided by the PPP. Federal short-term unemployment benefits also expire in July, yet social distancing is likely to continue until year’s end, further straining the economy as a result. The COVID Money Tracker July report shows that there is still $132 billion in available PPP money, and the deadline for businesses to apply has been extended until Aug. 8.

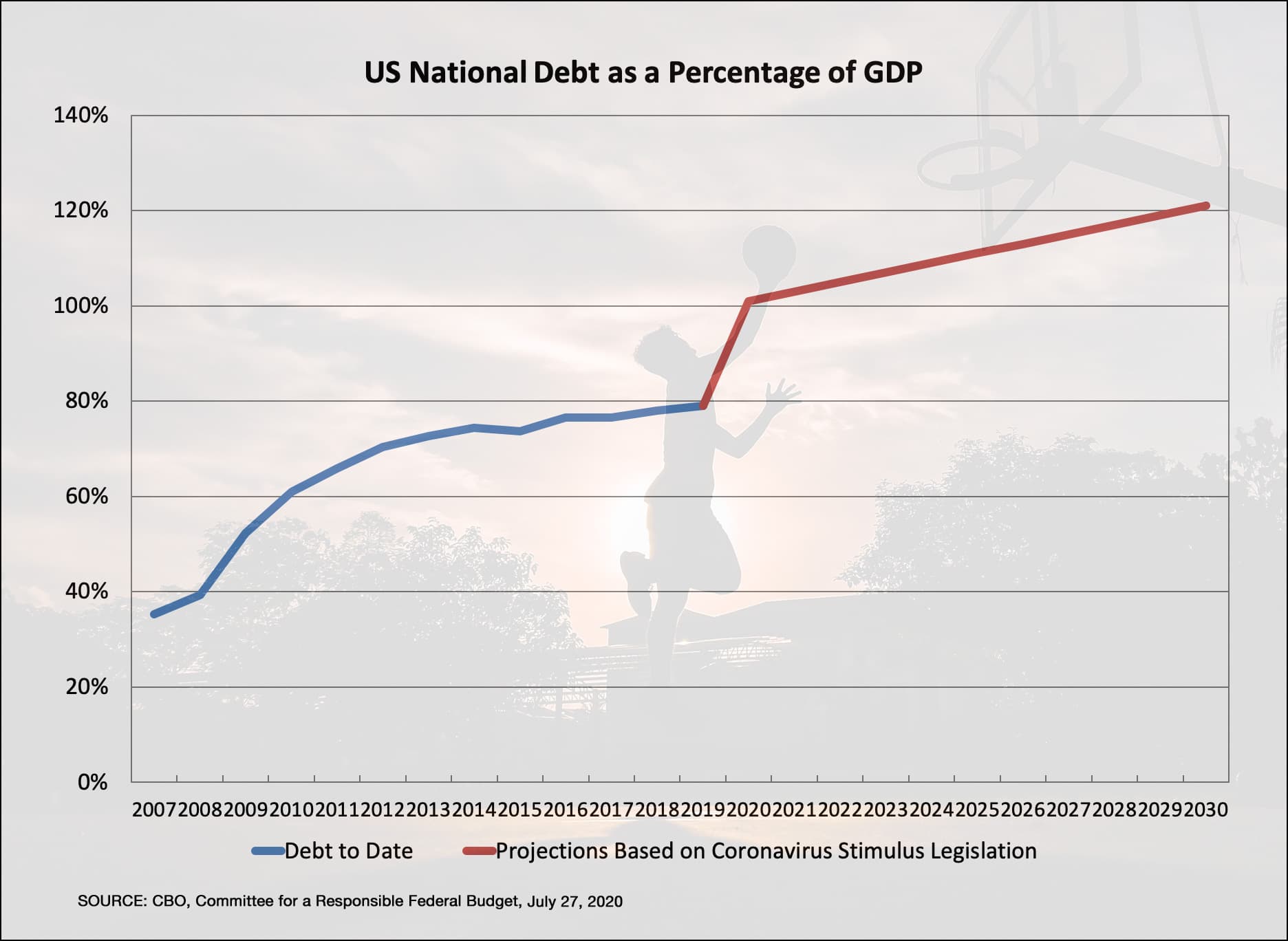

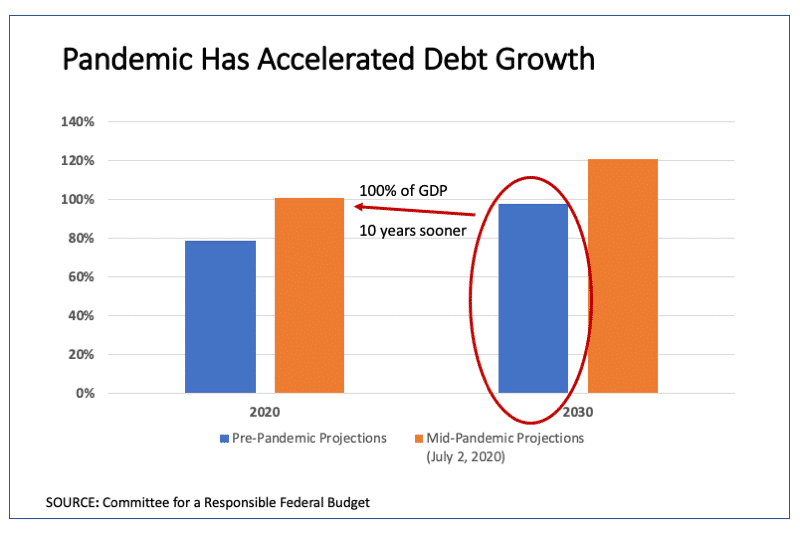

Additionally, analysis of approved legislation suggests that the national debt will increase at an accelerated rate, reaching 100% of GDP ten years sooner than projected before the pandemic. As of July 2, the CRFB projects the debt will reach 101% of GDP by the end of 2020; prior to the pandemic, it had estimated debt in 2030 would be 98% of GDP. Now, it projects to be 121% of GDP by 2030. Additional COVID relief legislation will further accelerate debt growth.

Even at the current rate of debt accumulation, Spencer Dinwiddie may need to change his No. 26 jersey number just to keep up with the gross national debt, which is likely to eclipse $27 trillion in the not too-distant future.

Sources

Peter G. Peterson Foundation, “The national debt is now more than $26 trillion. what does that mean?”, 2020, https://www.pgpf.org/infographic/the-national-debt-is-now-more-than-26-trillion-what-does-that-mean, accessed Jul 14, 2020

Committee for a Responsible Federal Budget, “What’s in the Fourth Coronavirus Package?”, April 22, 2020, http://www.crfb.org/blogs/whats-fourth-coronavirus-package, accessed Jul 5, 2020

U.S. Small Business Administration, “Paycheck Protection Program (PPP) Report”, Jun 30, 2020, https://home.treasury.gov/system/files/136/PPP-Results-Sunday.pdf, accessed Jul 13, 2020

Committee for a Responsible Federal Budget, “Paycheck Protection Program Flexibility Act Signed Into Law”, Jun 8, 2020, http://www.crfb.org/blogs/paycheck-protection-program-flexibility-act-signed-law, accessed Jul 5, 2020

Committee for a Responsible Federal Budget, “COVID Money Tracker: Policies Enacted To Date”, Apr 20, 2020 (updated Jul 9, 2020), http://www.crfb.org/blogs/covid-money-tracker-policies-enacted-to-date, accessed Jul 13, 2020

U.S. Treasury Department, “SBA Paycheck Protection Program Loan Level Data”, Jun 30, 2020, https://home.treasury.gov/policy-issues/cares-act/assistance-for-small-businesses/sba-paycheck-protection-program-loan-level-data, accessed Jul 13, 2020

Committee for a Responsible Federal Budget, “A July Update on the Paycheck Protection Program”, Jul 10, 2020, http://www.crfb.org/blogs/july-update-paycheck-protection-program, accessed Jul 13, 2020

U.S. Census Bureau, “Small Business Pulse Survey: Tracking Changes During The Coronavirus Pandemic”, May 14, 2020, https://www.census.gov/data/experimental-data-products/small-business-pulse-survey.html, accessed Jul 13, 2020

Committee for a Responsible Federal Budget, “CBO Releases New Economic Projections”, Jul 2, 2020, http://www.crfb.org/blogs/cbo-releases-new-economic-projections-0, accessed Jul 5, 2020

Committee for a Responsible Federal Budget, “Webinar & Chartbook: What’s the Status of COVID Relief Money?”, Jun 3, 2020, http://www.crfb.org/papers/webinar-chartbook-whats-status-covid-relief-money, accessed Jul 5, 2020

Committee for a Responsible Federal Budget, “Updated Budget Projections Show Fiscal Toll of COVID-19 Pandemic”, Jun 24, 2020, http://www.crfb.org/papers/updated-budget-projections-show-fiscal-toll-covid-19-pandemic, accessed Jul 5, 2020

Committee for a Responsible Federal Budget, “Dunking on the Debt”, Jul 7, 2020, http://www.crfb.org/blogs/dunking-debt, accessed Jul 13, 2020

Congressional Budget Office, “The Budget and Economic Outlook: 2020 to 2030”, January 2020, https://www.cbo.gov/publication/56073#_idTextAnchor020, accessed Jul 21, 2020

Have a Suggestion?

Know a leader? Progress story? Cool tool? Want us to cover a new problem?